Information from U.S. Bank

U.S. Bank is Proud to be your Campus Banking Partner.

Make Your ISU Card the only Card on and off Campus!

Smart banking starts here.

From financial wellness to banking solutions, U.S. Bank is your partner for today and what’s to come. Open a U.S. Bank Smartly® Checking account1 and link to your ISUCard to make it your Campus ID and ATM/Debit Card -- all in one. Plus, save for your future when you pair your checking account with a U.S. Bank Smartly® Savings account2 and unlock even better benefits.

Learn more about how U.S. Bank can help you get closer to your goals and prepare for whatever’s next.

For your convenience, U.S. Bank has 3 ATMs on campus located in the Memorial Union Food Court, Maple-Willow-Larch Commons, and Union Drive Community Center. In addition, we have two branches in Ames, Iowa including our Ames University Branch that across the street from Friley Hall.

- 2546 Lincoln Way (515-292-2638)

- 405 Main Street (515-232-8200)

1. All regular account opening procedures apply. $25 minimum deposit is required to open a U.S. Bank checking account. Fees for non-routine transaction may apply.

2. The interest rates and APYs for the U.S. Bank Smartly® Savings account are variable, determined at the bank’s discretion, and can change at any time, including after the account is opened.

Your school chose U.S. Bank to add optional banking functionality to the campus ID card and may receive financial support from U.S. Bank to offset costs otherwise incurred by the school. Students, faculty, and staff are not required to open an account with U.S. Bank to receive or use the campus ID card for other campus services.

Deposit products are offered by U.S. Bank National Association. Member FDIC. ©2025 U.S. Bank.

Free guidance for your goals.

Your goals are important. U.S. Bank offers free one-on-one goals coaching to all Iowa State students. Whether your goal is related to career building, financial decisions or anything life throws at you, a goals coach is here to assist you in making those goals a reality. Through virtual conversations, you can take control of your future, your way. Sign up now at usbank.com/goals.

Boost your financial IQ

U.S. Bank offers financial resources to help you manage your money throughout college and beyond. Visit the Financial IQ Student Center to learn more about budgeting, investing, protecting your finances and more.

You could win up to $20,000 in scholarships!

Grow your financial IQ, earn gift cards and enter for a chance to win a U.S. Bank scholarship. Sign up now!

Scholarship runs from February 1 – October 30, 2025.

ONLINE/DIGITAL DISCLAIMER:

NO PURCHASE NECESSARY TO ENTER OR WIN. Enter online between 2/1/25 and 10/30/25. Open to legal residents of the 50 U.S. or D.C, who are at least 17 years of age or older, and are accepted or enrolled as an undergraduate student (for at least 6 credit hours per semester) as of Sept 1, 2026, at an eligible, accredited two- or four-year U.S. brick and mortar or online college or university or trade or vocational school. Limit seven (7) Entries per person/authorized email account holder regardless of entry method during the Promotion Period. Void where prohibited by law. See rules for full details. (live link) Sponsored by U.S. Bank, 200 South 6th Street, Minneapolis, MN 55402.

* All regular account opening procedures apply. $25 minimum deposit is required to open a U.S. Bank checking account. Fees for non-routine transaction may apply. Deposit products offered by U.S. Bank National Association. Member FDIC. ©2023 U.S. Bank. Your school chose U.S. Bank as its partner to offer students, faculty, and staff the option to add banking functionality to the campus ID card.

Your school may receive financial support from U.S. Bank in the form of marketing funds, royalties, card stock or other compensation to offset costs otherwise incurred by the school. Students, faculty, and staff are not required to open an account with U.S. Bank to receive or use the campus ID card for other campus services.

- Learn more about U.S. Bank

- U.S. Bank and Iowa State University Agreement

- U.S. Bank ATM Campus Location Map

U.S. Bank and Iowa State University Agreement

Iowa State University chose U.S. Bank as its partner to offer students, faculty and staff the option to add banking functionality to the ISU Card. ISU receives financial support from U.S. Bank in the form of marketing funds, royalties, card stock, and other compensation to offset costs otherwise incurred by the school. Students, faculty and staff are not required to open an account with U.S. Bank to receive or use the ISU Card for other campus services. The university partnership with U.S. Bank was formed after a competitive selection process (U.S. Bank and Iowa State University Agreement). Questions about the University’s partnership with U.S. Bank may be directed to the ISU Card Office at 515-294-2727 or by email to idcard@iastate.edu.

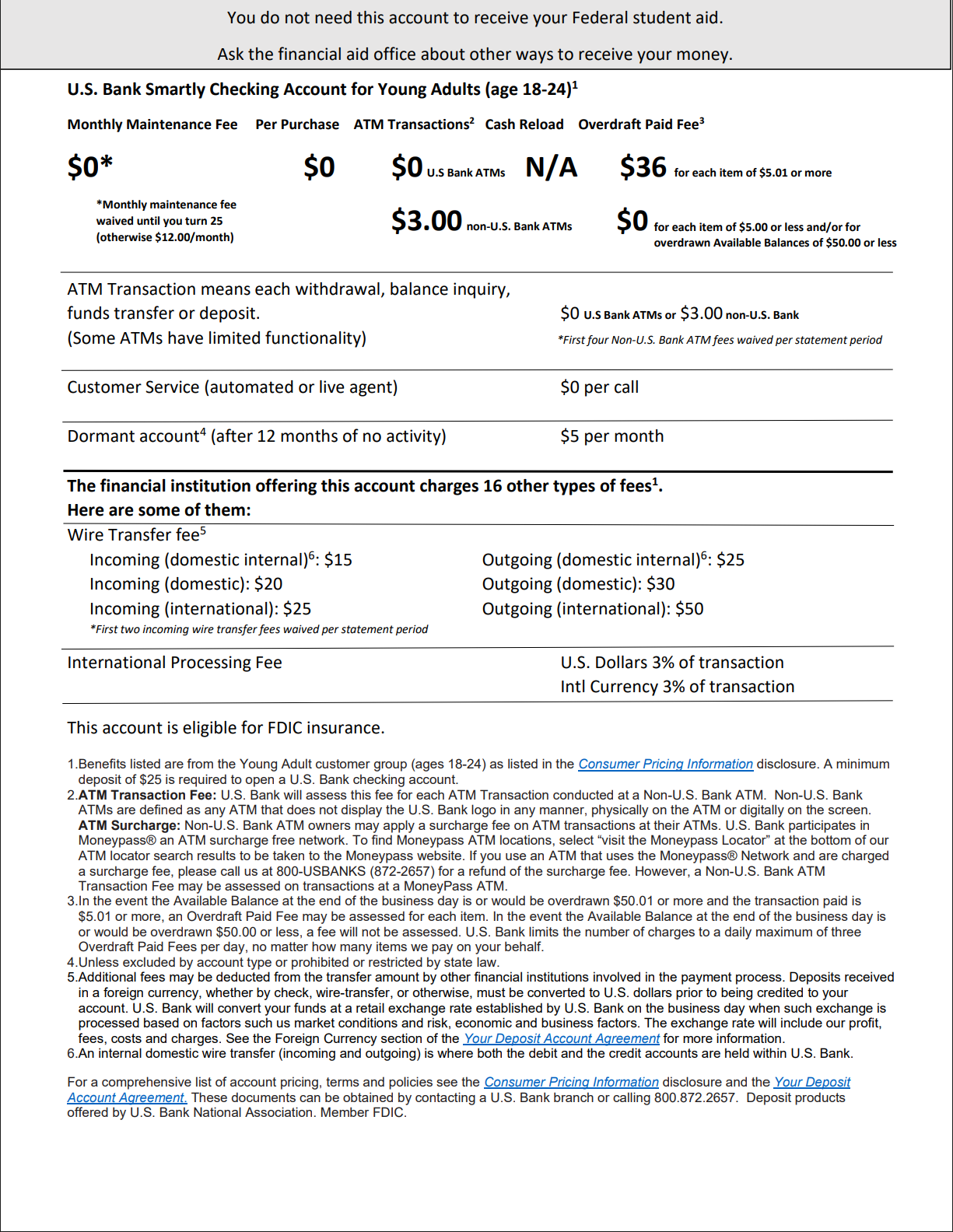

For a comprehensive list of account pricing, terms and policies see the Consumer Pricing Information disclosure and the Your Deposit Account Agreement. These documents can be obtained by contacting a U.S. Bank branch or calling 800.872.2657. Deposit products offered by U.S. Bank National Association. Member FDIC.